We’re a global leader in premium drinks, the most exciting consumer products space.

Performance highlights

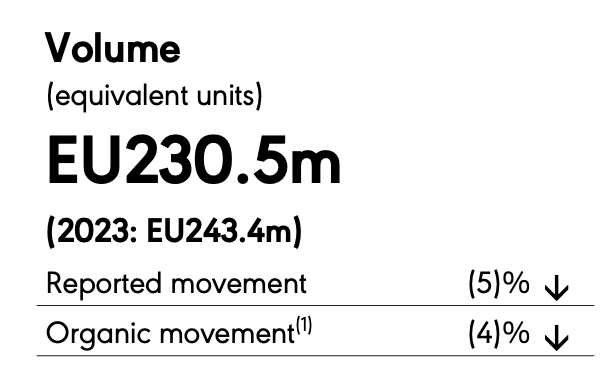

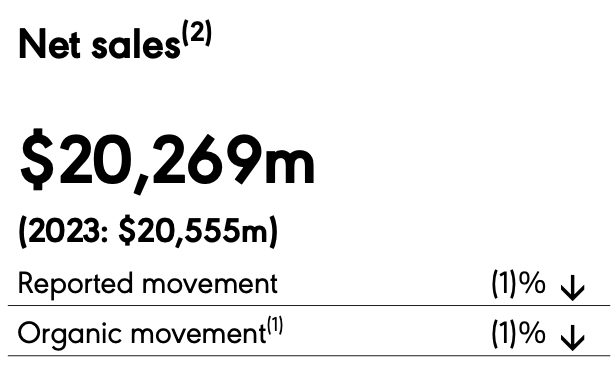

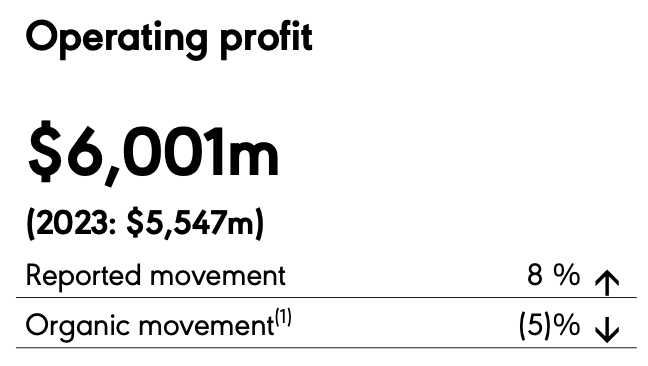

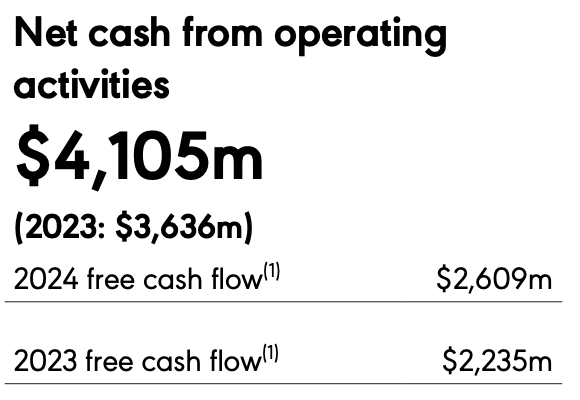

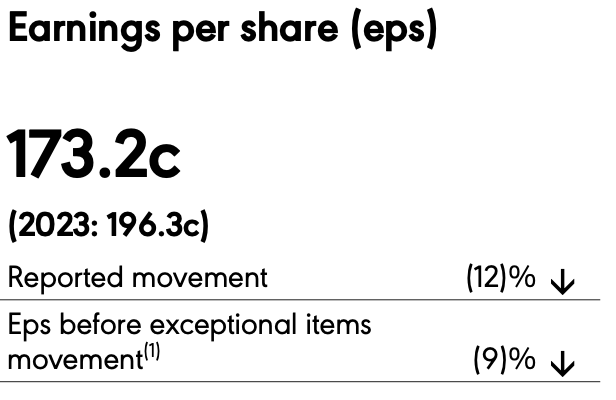

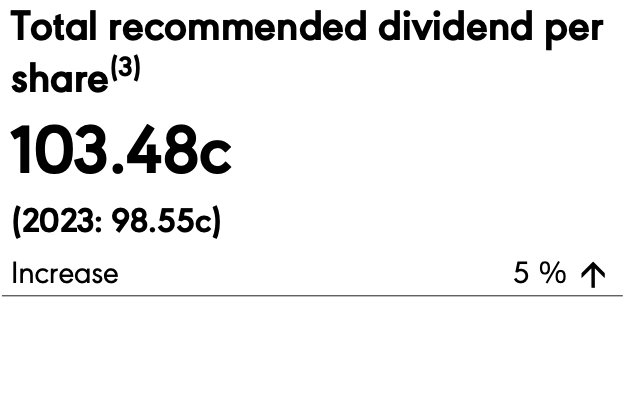

Financial performance

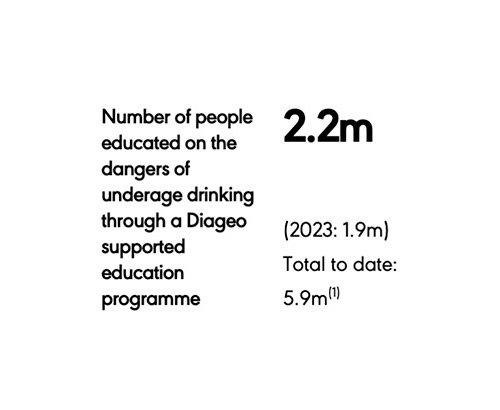

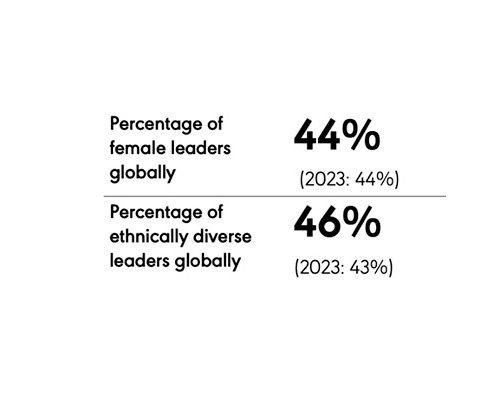

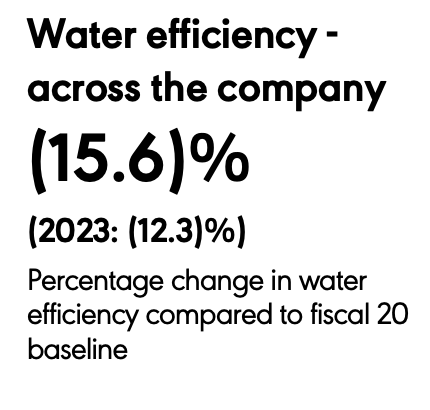

Non-financial performance

Whether you’re heading out...

or hosting at home...

Market Overview

Market overview and investment case

Total Beverage Alcohol (TBA) is a highly attractive and exciting consumer category. TBA is resilient and growing; and the spirits category is growing even faster. TBA has grown at 4.4% CAGR in the 10 years through to 2023, and international spirits has grown at 5.1% over the same period.(1)

(1) IWSR, 2023.

Consumers are choosing spirits

Diageo sees a long-term trend of consumers choosing to switch to spirits from beer and wine, driving volume growth for spirits. This growth is supported by favourable population demographics, the increasing size of the middle class in key markets globally and strong premiumisation trends. These are expected to continue into the future.

People drinking better, not more

Long runway for growth

In 2021, we set out our ambition to grow TBA share by 50% from 4% to 6% by 2030, and we remain confident that we will achieve this. With only 4.5% value share of TBA(1) currently, we have significant headroom for sustainable long-term growth

Delivering our Growth Ambition

Our Growth Ambition is our evolved strategy to win in fiscal 25 and beyond and to deliver the next phase of sustainable growth.

Through the Growth Ambition we will continue to focus on delivering on four key strategic outcomes that are now embedded in the business: providing efficient growth; delivering consistent value creation; building credibility and trust; and ensuring that our people and high-performing teams are fully engaged.

Growth Ambition

Celebrating life every day, everywhere

To create one of the best performing, most trusted and respected consumer product companies in the world

Unleash the power of our brands and portfolio to lead and shape consumer trends executed with operational excellence

BRANDS AND PORTFOLIO

- Whisk(e)y and tequila

Winning local portfolio

Guinness growth -

Comsumer Trends

- Premiumisation

Recruitment

New occasions -

Operational excellence

- Evolve brand building muscle Commercial excellence

Everyday efficiency -

Building a more Digital Diageo

Diverse and engaged talent with a focus on culture

Spirit of Progress and doing business the right way from grain-to-glass

Achieve quality TBA share of 6% by 2030

Efficient growth

Consistently grow organic net sales, grow operating profit, deliver strong free cash flow

Consistent value creation

Top-tier total shareholder returns, increase return on invested capital

Credibility and trust

Engaged people

High-performing and engaged teams, continuous learning, inclusive culture

Performance against our Spirit of Progress

Spirit of Progress, our ongoing ESG action plan, addresses the most significant environmental and social opportunities and risks Diageo faces. It has three priorities to promote positive drinking, champion inclusion and diversity and pioneer grain-to-glass sustainability. Doing business the right way underpins everything we do.

Our ESG reporting approach

Our ESG reporting suite aims to provide comprehensive and comparable disclosures for a broad range of stakeholders. As well as publishing our integrated Annual Report and ESG Reporting Index each year, we also submit non-financial information to benchmarking and index organisations, including those listed on the Awards and ranking page of our website.

The non-financial reporting space is evolving quickly. We are committed to continually evaluating and improving our approach and to actively tracking emerging ESG regulation, frameworks and good practice. Since launching our Spirit of Progress ESG action plan, we have set out to help create a more inclusive and sustainable world, creating a positive impact in our company, and for our society.

Case studies

Downloads

| 1 AUG 2024 | DOWNLOAD |

Annual Report 2024 |

|

Strategic report 2024 |

|

Governance report 2024 |

|

Audit Committee report 2024 |

|

Business Model 2024 |

|

Chairs Statement 2024 |

|

Directors' remuneration report 2024 |

|

Chief Executives Statement 2024 |

|

Corporate Governance Report 2024 |

|

Financial Report 2024 |

|

Nomination Committee Report 2024 |

|

20-F filing 2024 |

|

Instantly Recognisable Brands 2024 |

|

Market Overview and Investment Case 2024 |

|

Our Growth Ambition 2024 |