We’re a global leader in premium drinks, the most exciting consumer products space.

Performance highlights

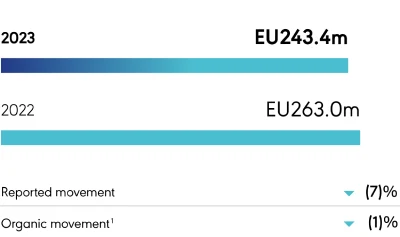

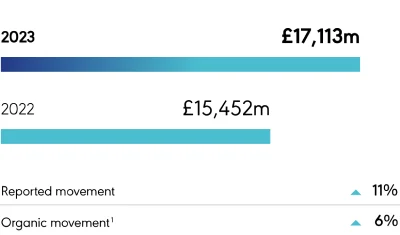

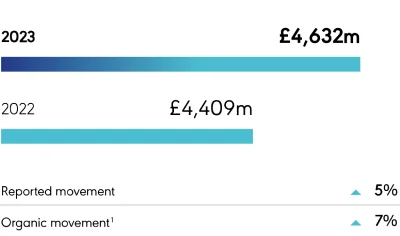

Financial performance

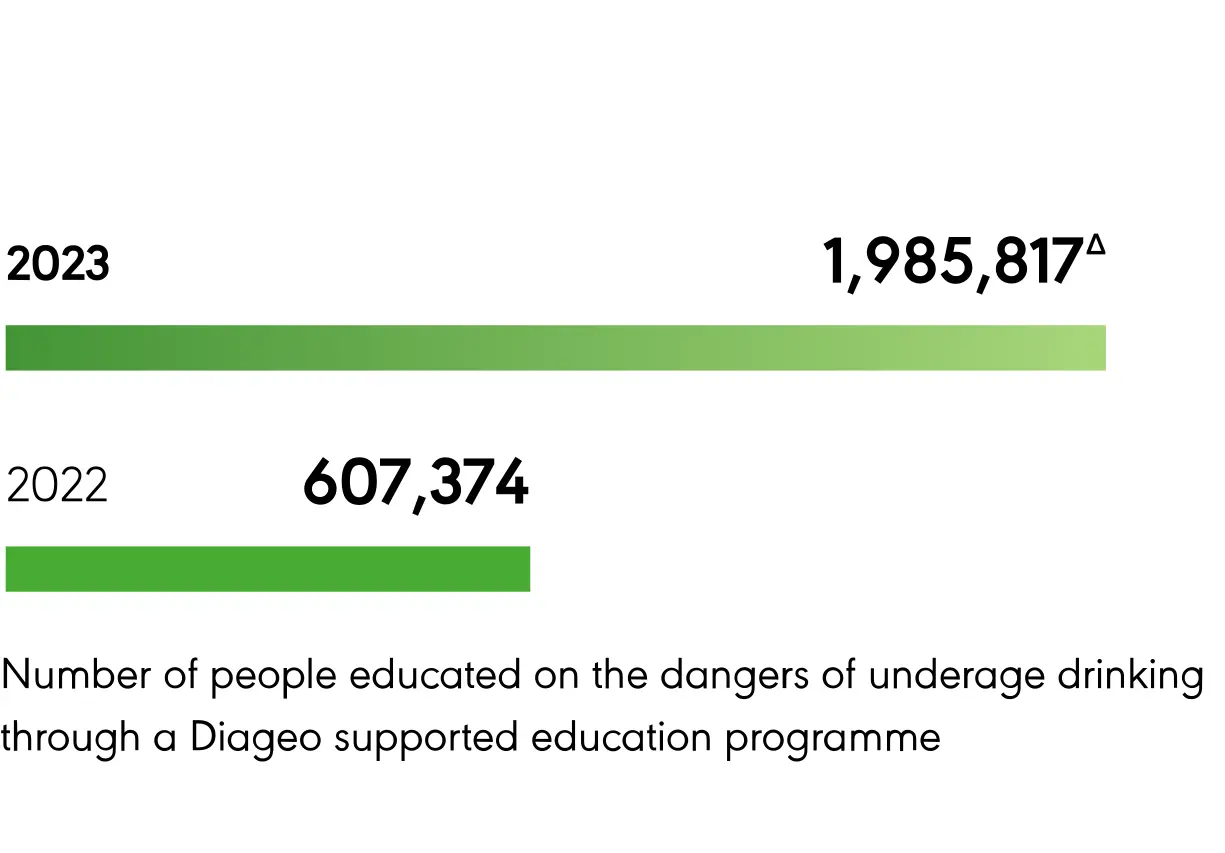

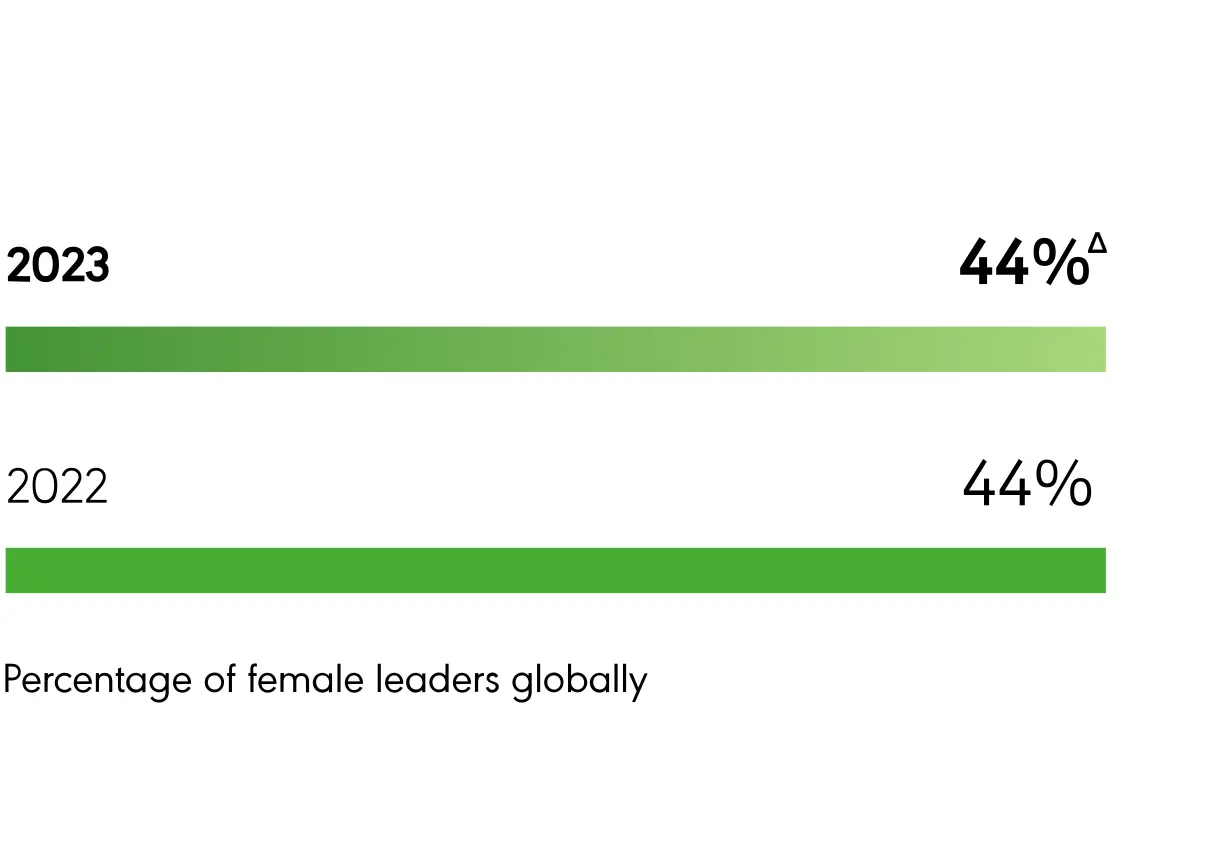

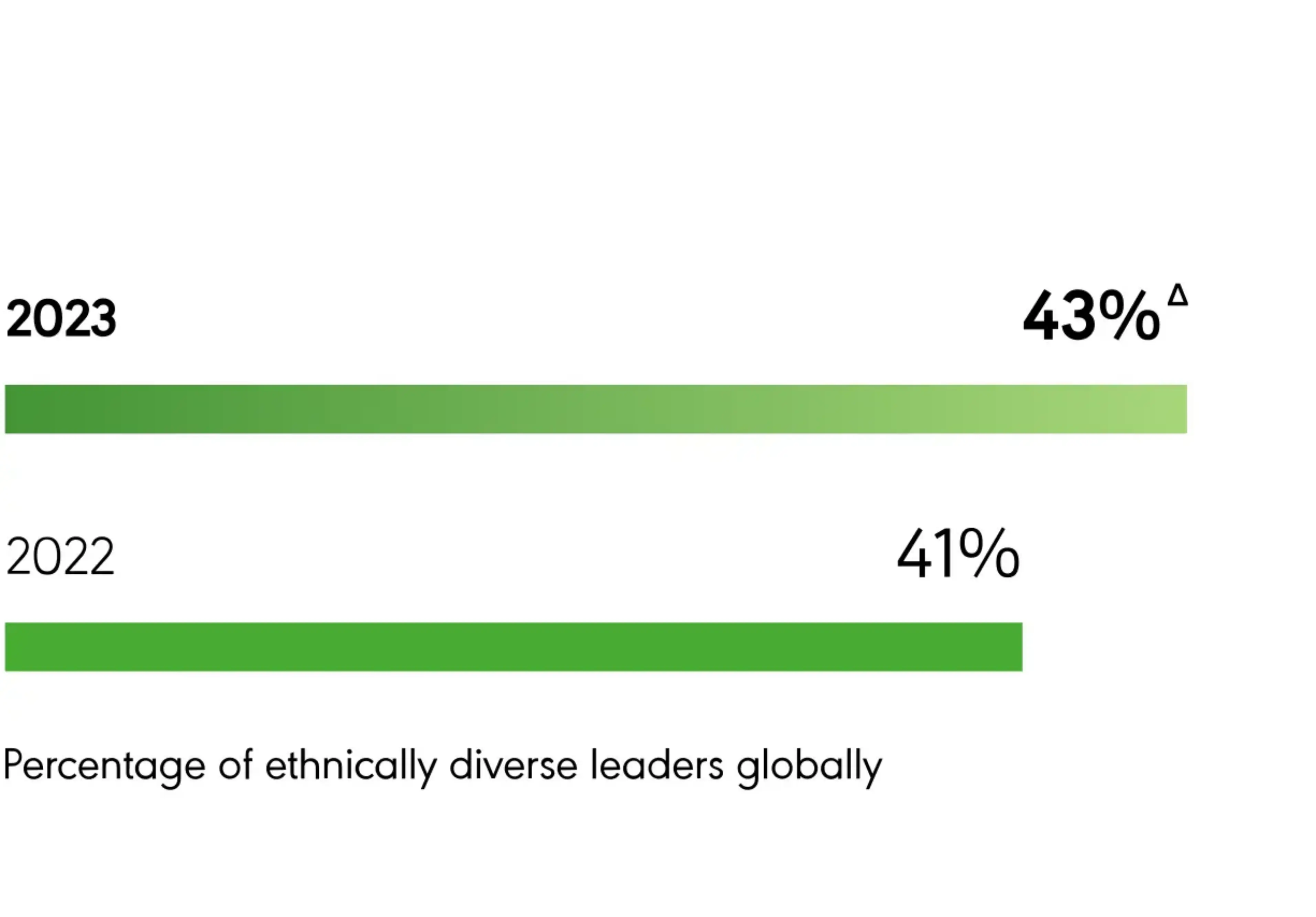

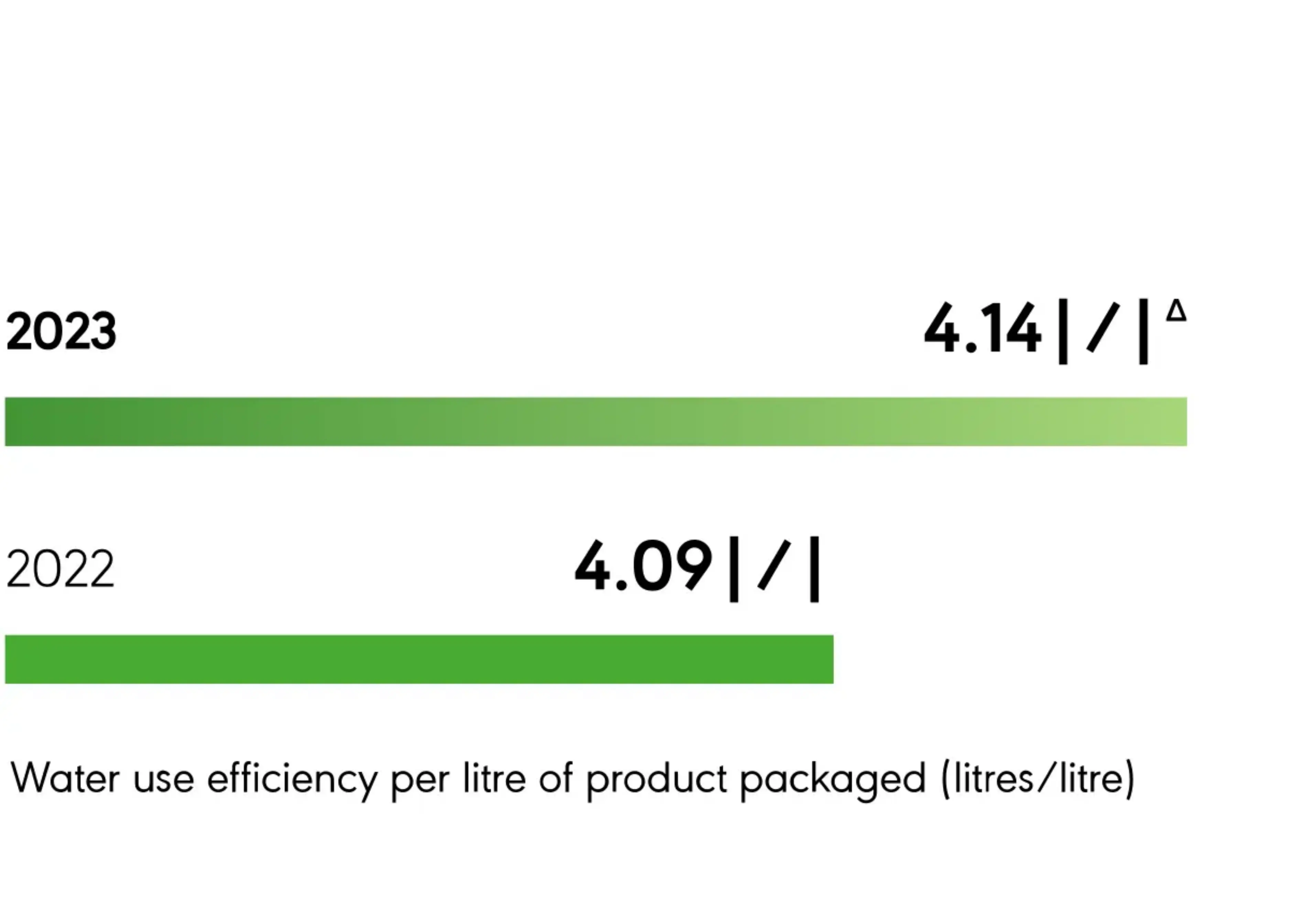

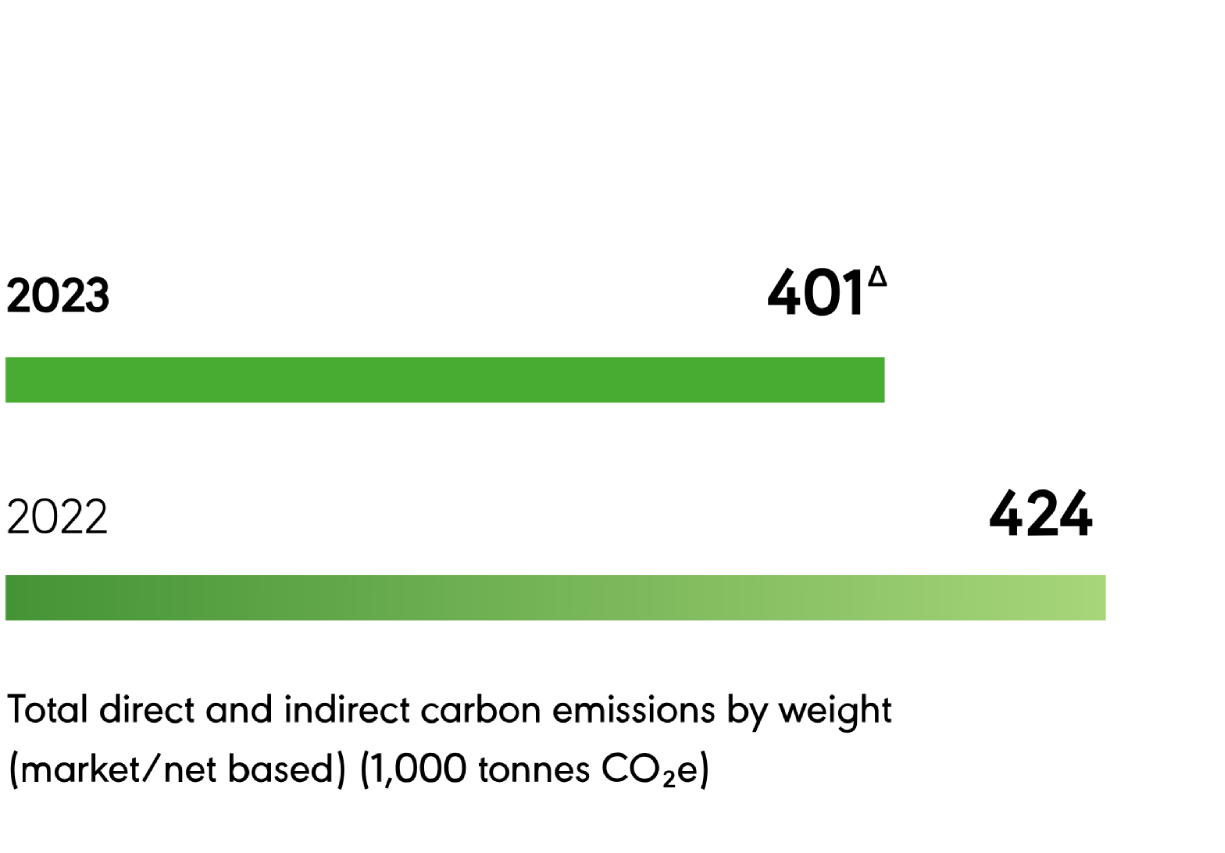

Non-financial performance

(1) See Definitions and reconciliation of non-GAAP measures to GAAP measures on pages 232-239

(2) Net sales are sales less excise duties

(3) Includes recommended final dividend of 49.17p

(4) In accordance with Diageo’s environmental reporting methodologies and, where relevant, WRI/WBCSD GHG Protocol; data for the baseline year 2020 and for the intervening period up to the end of last financial year has been restated where relevant

Δ Within the scope of PricewaterhouseCoopers LLP’s (PwC) independent limited assurance reported to the Directors. For further detail and the reporting methodologies, see pages 242-266.

Unless otherwise stated in this document, percentage movements refer to organic movements. For a definition of organic movement and reconciliation of all non-GAAP measures to GAAP measures, see pages 232-239. Share refers to value share. Percentage figures presented are reflective of a year-on-year comparison, namely 2022-2023, unless otherwise specified.

Our brands

Brand building expertise

With over 200 brands and sales in more than 180 countries, our portfolio offers something for every taste and celebration.

From much-loved, established brands, like Johnnie Walker, to the latest innovations, like Tanqueray 0.0, we create products, tastes and experiences for people to enjoy.

This requires focus and investment in what we call a brilliant blend of ‘creativity with precision’. We combine data, insights and innovation with the creative flair our consumers expect from us as a custodian of some of the most iconic brands in the world.

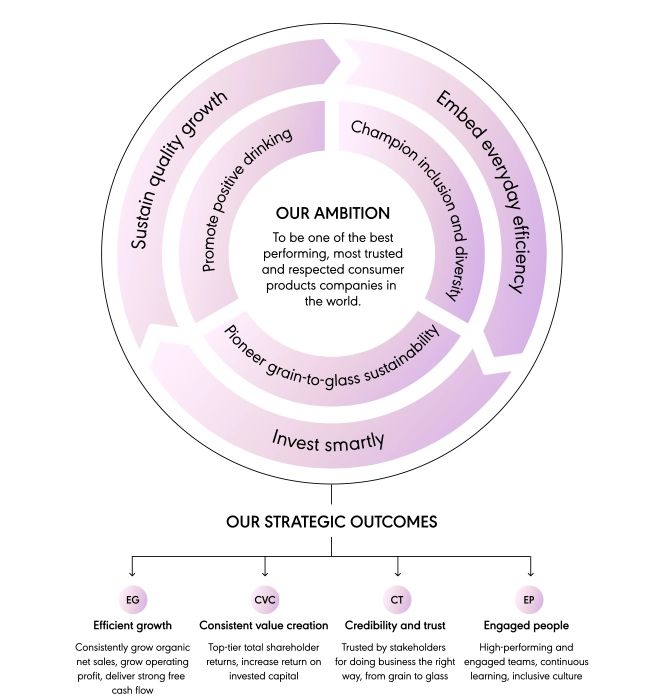

Delivering our Performance Ambition

Our six strategic priorities support the achievement of our ambition to be one of the best performing, most trusted and respected consumer products companies in the world. Through these priorities, we deliver the strategic outcomes against which we measure our performance.

Market overview

An attractive industry with a runway for growth

Total beverage alcohol (TBA) has seen a strong record of value growth over the last 10 years. And international spirits, where Diageo is the number one player, has grown faster than TBA.1

We believe TBA presents sustainable long-term growth opportunities for Diageo, underpinned by attractive consumer fundamentals. This includes three key factors: a growing middle class; increased spirits penetration; and premiumisation in both developed and emerging markets.

Retail sales value of global alcohol market¹

Expected to join the middle class and above income bracket by 2032²

Equivalent units of alcohol sold¹

new legal purchase age consumers expected to enter the market by 2033²

increase in spirits TBA share¹

1 IWSR, 2022

2 World Bank

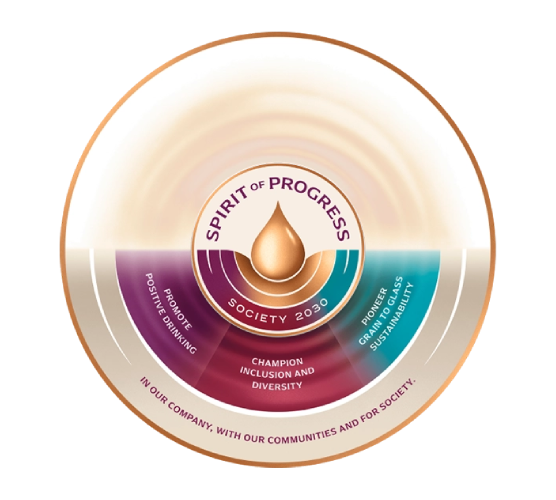

Performing against our 2030 targets

Our 25 Spirit of Progress targets underpin our 10-year ESG action plan to help create a more inclusive and sustainable world and are aligned with the United Nations’ Sustainable Development Goals. The targets build on our long and ambitious track record on environmental, social and governance (ESG) issues.

Our ESG reporting approach

Our ESG reporting suite aims to provide comprehensive and comparable disclosures for a broad range of stakeholders. As well as publishing our integrated Annual Report and ESG Reporting Index each year, we also submit non-financial information to benchmarking and index organisations throughout the year, including those listed on the Awards and ranking page of our website.

The non-financial reporting space is evolving quickly. We are committed to continually evaluating and improving our approach and to actively tracking emerging ESG regulation, frameworks and good practice.

| Focus area | Relevant policies and standards |

Promote positive drinking |

Global Marketing and Digital Marketing Policy Employee Alcohol Global Policy Position paper: Consumer Information |

Champion inclusion and diversity Our people |

|

Pioneer grain-to-glass sustainability |

|

Human rights |

|

Health and safety |

|

Anti-bribery and corruption |

Case studies

Downloads

| 3 AUG 2023 | DOWNLOAD |

Annual Report 2023 |

|

Annual Report strategic report 2023 |

|

Governance report 2023 |

|

Audit Committee report 2023 |

|

Directors' remuneration report 2023 |

|

ESG Reporting Index 2023 |

|

NYSE Statement of Difference 2023 |

|

Latest Corporate Citizenship assurance statement |

|

20-F filing 2023 |

|

Annual Report 2023 in ESEF format |