We’re a global leader in premium drinks, the most exciting consumer products space.

View

25 Feb 2026

Fiscal 26 Interim Results

19 May 2025

2025 Q3 Trading Statement

2025 Interim Results

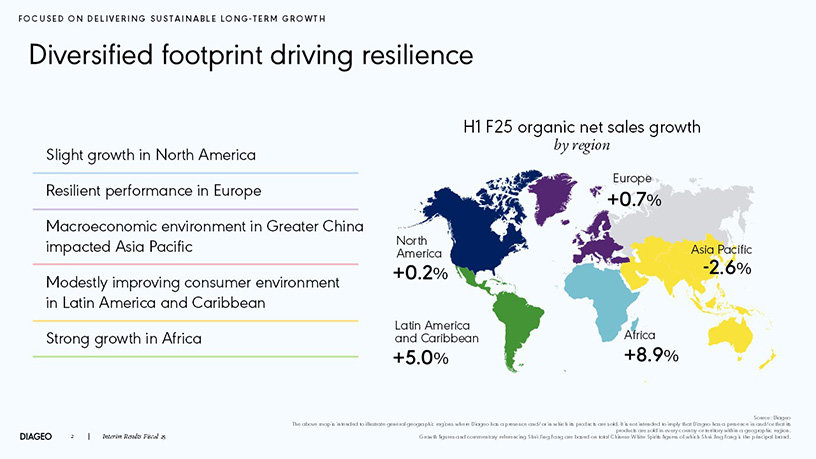

Organic net sales growth.

Free cash flow driven by strong working capital management.

Diageo grew or held total market share in 65% of total net sales value in measured markets, including in the US.

Our top highlights

2024 Preliminary Results

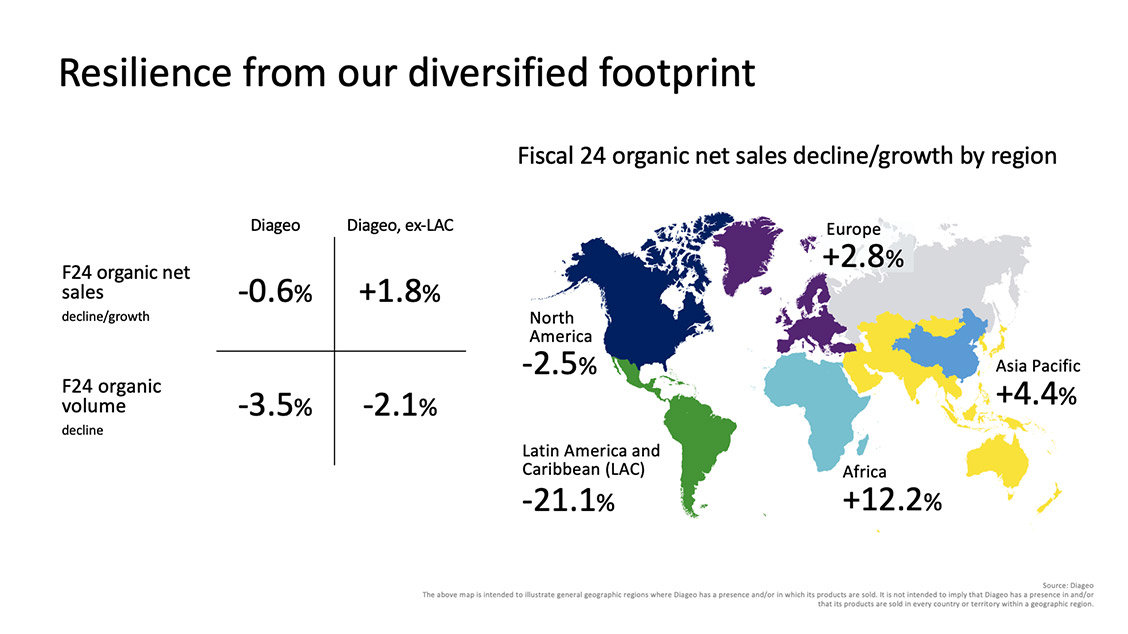

Excluding the impact of LAC, organic net sales grew 1.8%, driven by growth in Africa, Asia Pacific and Europe.

We grew or held total market share in over 75% of total net sales value in measured markets.

Increased recommended full year dividend by 5%, maintaining our track record of increases since Diageo's formation over 25 years ago.

Our top highlights

2024 Interim Results

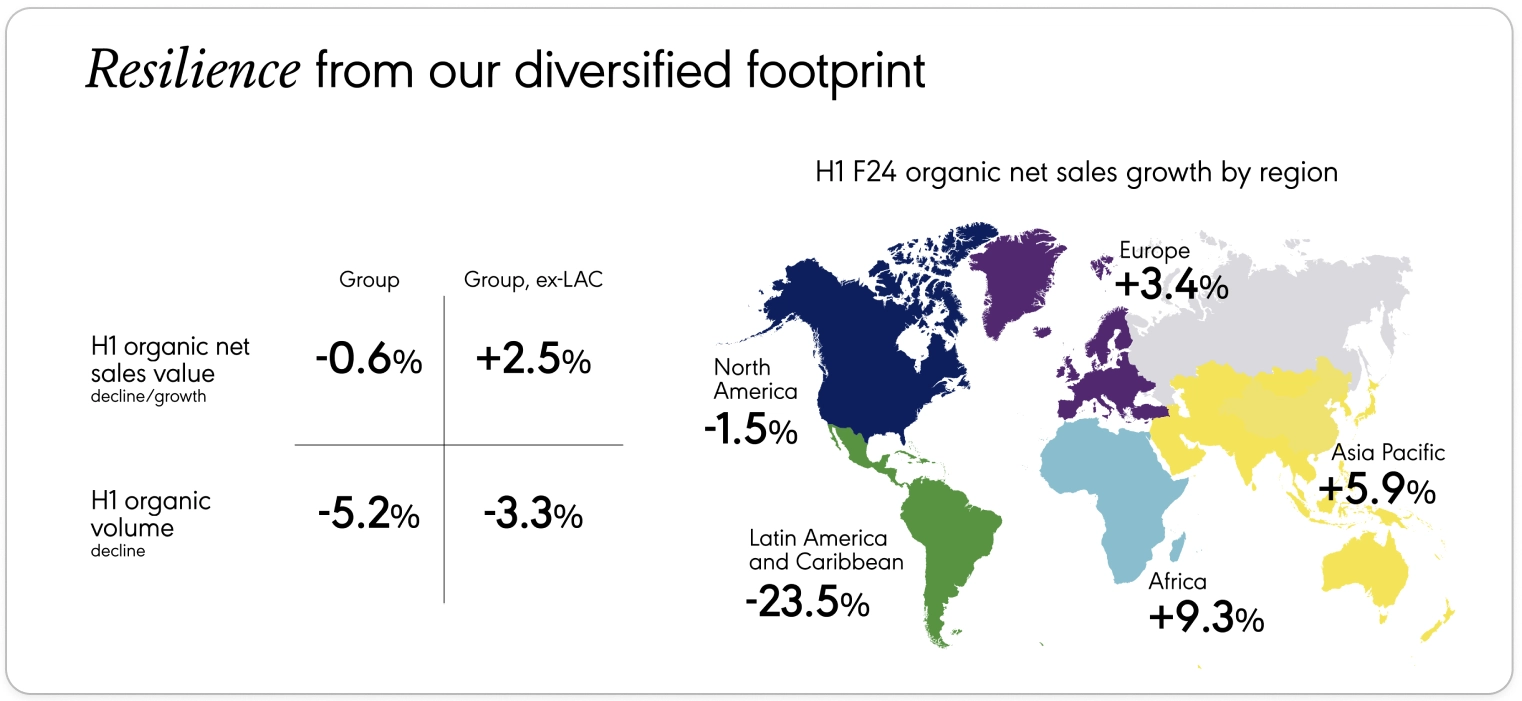

Excluding LAC, organic net sales grew 2.5%, driven by good growth in Europe, Asia Pacific and Africa.

Generated strong free cash flow of $1.5 billion, up $0.5 billion.

Increased dividend by 5%, maintaining our track record of increases since Diageo’s formation over 25 years ago.

Our top highlights

10 Nov 2023

Trading Update

01 Aug 2023

2023 Preliminary Results

26 Jan 2023

2023 Interim Results

28 Jul 2022

2022 Preliminary Results

27 Jan 2022

2022 Interim Results

29 Jul 2021

2021 Preliminary Results

28 Jan 2021

2021 Interim Results

04 Aug 2020

2020 Preliminary Results

30 Jan 2020

2020 Interim Results

25 Jul 2019

2019 Preliminary Results

31 Jan 2019

2019 Interim Results

26 Jul 2018

2018 Preliminary Results

25 Jan 2018

2018 Interim Results

27 Jul 2017

2017 Preliminary Results

26 Jan 2017

2017 Interim Results

28 Jul 2016

2016 Preliminary Results

28 Jan 2016

2016 Interim Results

30 Jul 2015

2015 Preliminary Results

29 Jan 2015

2015 Interim Results

31 Jul 2015

2014 Preliminary Results

30 Jan 2014

2014 Interim Results

31 Jul 2013

2013 Preliminary Results

31 Jan 2013

2013 Interim Results

23 Aug 2012

2012 Preliminary Results

09 Feb 2012

2012 Interim Results

25 Aug 2011

2011 Preliminary Results

10 Feb 2011

2011 Interim Results

26 Aug 2010

2010 Interim Results

26 Aug 2010

2010 Preliminary Results

You've viewed 36 of 36 results